The yearly dance to balance what the city wants to spend versus what taxpayers are willing to pay is underway.

The initial budget presentation, which includes a tax rate that raises the amount property owners will owe, was discussed at City Council Aug. 8. More meetings and public hearings are planned before the budget is locked into place Oct. 1.

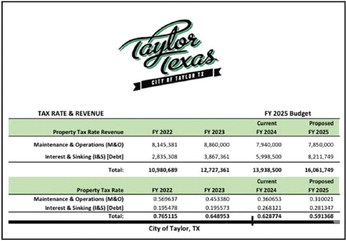

“The budget is based on the voter-approval rate of 59.1368 (cents per $100 property valuation), which will generate, at a 98 percent collection rate, $7.85 million,” said Jeff Wood, the city’s chief financial officer.

The proposed 59-cent rate is the highest the city could charge without requiring voter approval. It is lower than the Fiscal Year 2024 rate of 62.8774 cents per $100 of property value, but due to a rise in appraised values, it means most owners will be paying more on their tax bill.

To avoid that increase, the city would need to adopt the no-new-revenue rate of 55.5974 cents.

“The Fiscal Year 2025 budget will raise more total property taxes than last year’s budget by $2,924,500, which is a 19.5% increase, and of that amount $2,493,976 is tax revenue to be raised from new property added to the tax roll this year,” according to a statement from the city.

The budget includes general-fund revenues of $32,006,622 and expenditures of $32,070,459. With special-revenue funds, impact funds and other income sources, the combined budget totals $67,560,022 in revenue with expenditures of $66,752,018.

The general fund has a deficit of about $63,000, officials said.

Wood noted the budget includes $124,000 to be used in association with a Staffing for Adequate Fire and Emergency Response federal grant. The grant has not yet been awarded, and if not approved that money will wipe out the $63,000 deficit and result in a $61,000 surplus.

“Ideally you would want to have a totally balanced budget, but when you’re dealing with 3,300 different accounts and you’re talking about $32 million in just the generalfund budget alone, it’s pretty hard to zero in,” Wood said.

While the amount of money the city is collecting increases every year, the amount being used for maintenance and operations of the town has been decreasing. It went from $8.86 million in FY 2023 to $7.94 million in FY 2024 to $7.85 million proposed in FY 2025.

Meanwhile, the amount it costs the city to pay down debt is increasing. Interest and sinking, the portion of taxes spent on debt servicing, has risen from $3.86 million in FY 2023 to $8.21 million in FY 2025.

“As we talk about the parity between (maintenance and operations) and debt, you can see that over the last six years the M&O rate has been cut in half,” Wood said.

Meanwhile the city is looking to issue more debt in 2025 to help pay for $253 million in anticipated capitalimprovement projects.

A public hearing on the budget is 6 p.m. Aug. 22 in the Council Chambers, 400 Porter St. During the session, the maximum tax rate will be set.

Elected leaders will vote to make changes or adopt the budget as-is at their Sept. 12 gathering. Any changes made at this time will affect the proposed tax rate.

The public hearing for the tax rate will be held at the Sept. 12 session, and the council will vote to adopt a tax rate immediately afterwards.

The complete budget proposal, as well as last year’s budget, can be viewed at taylortx. gov/23/finance.

“

“Ideally you would want to have a totally balanced budget.”

— Jeff Wood, city chief financial officer