HUTTO – After a hotlydebated first budget draft proposed a tax rate higher than the “no-new-revenue” amount, Hutto City Council voted unanimously to adopt a lower budget based on the NNR tax rate at its Sept. 15 meeting. The NNR rate will effectively decrease the city burden on property owners by taking into account the amount of taxes collected from newly-built properties.

Hutto Chief Financial Officer Angie Rios presented a revised budget and tax rate to the council, which will decrease the property tax rate from $0.536448 to $0.42198 per $100 valuation. She prefaced the presentation by saying “I’m really disappointed the rest of the audience didn’t stay,” referencing the group of concerned citizens that had come to speak against the previously proposed tax rate. The council approved the budget and tax rate without dissent.

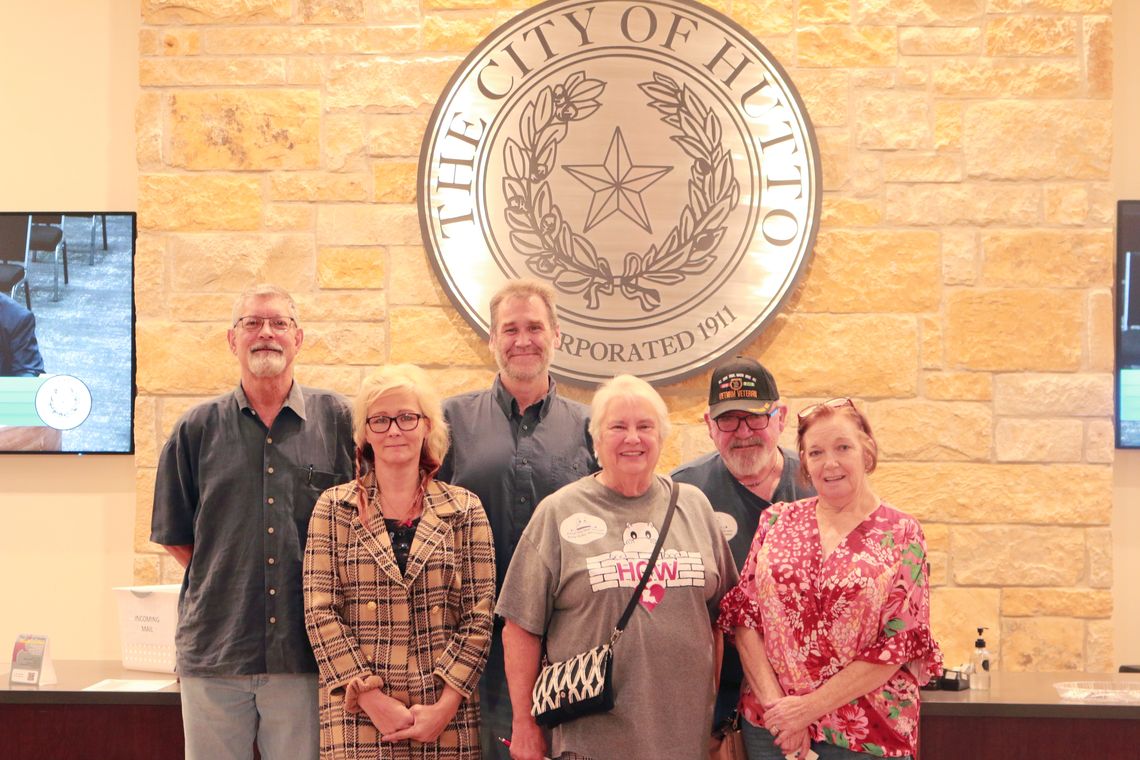

One of the citizens who spoke out was Jackie Corbiere, head of a local nonprofit organization and longtime Hutto resident.

“I was just amazed and in shock,” she said after learning of the results. “I feel like they finally did what they were supposed to do and listened to their constituents. There were a lot of people who came out both weeks. A lot of people showed up. And there wasn’t one person at either of the meetings that stood up and spoke in favor of (the originally proposed higher rate).”

Although the vote passed unanimously, some council members cautioned that it might not be sustainable.

“We have half the park land we should have. We have public safety issues,” said Krystal Kinsey, Place 5 council member. “Growing responsibly doesn’t always mean we’re going to have to continually adopt no new revenue, no new revenue, no new revenue. That also goes along with financial stability. We need to make sure we’re not short-sighted.”

Place 3 council member Randal Clark agreed that future tax rates would require hard discussions.

“This (NNR rate) now positions Hutto’s city taxes as the lowest taxing rate city in all of Williamson County once you adjust for the home values. We should be applauded that we got there, but also we have large infrastructure projects in the future.”

Under the new rate, the average Hutto homeowner can expect a decrease in their yearly tax bill of 5.28%, according to city staff. Rios said that despite the lower tax rate, the city’s total expected tax levy will increase approximately 18% due to approximately $500 million in new properties added to the tax rolls.

The city’s approved budget for FY 2022-23 includes $104.5 million in total expenditures, which Rios described as “balanced”. The council also approved the issuance of $25 million in general obligation bonds during the Sept. 15 meeting. The new tax rate along with the operating budget will go into effect Oct. 1.