The latest sales-tax receipts could indicate a shift to Taylor’s economy, with the mayor and other officials crediting the “Samsung effect.”

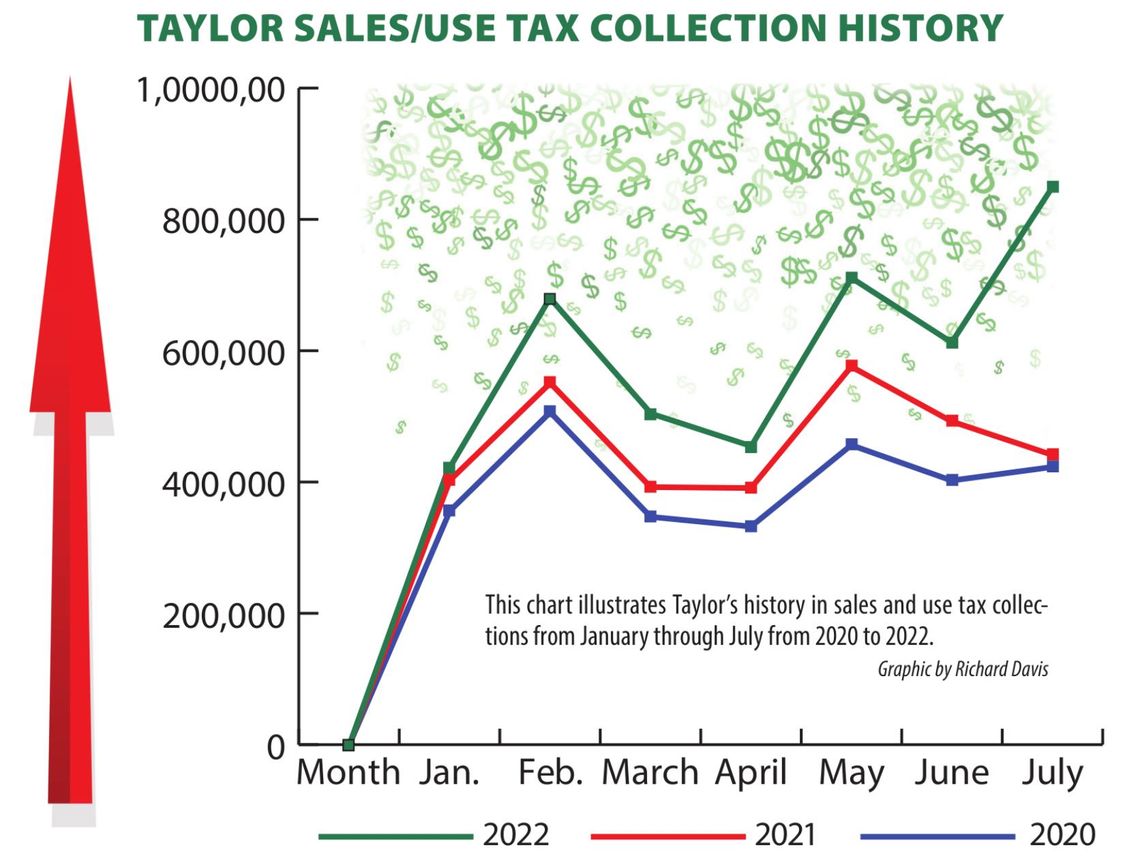

July sales and use tax collections were up 91.94% in comparison to the same month last year. The Texas Comptroller of Public Accounts shows Taylor’s July collections as $849,121 this year and $442,381 in 2021.

“These are early days,” said Mayor Brandt Rydell who, along with other area leaders, predicts a major upward shift in local commerce.

The Samsung Effect

Samsung Austin Semiconductor has begun construction on a multibillion-dollar manufacturing facility in southwest Taylor with fabrication plants. Influences from its arrival have been coined by Rydell and others as the “Samsung Effect.”

“This is positive news overall to see the Samsung effect occurring on the sales tax,” said Deputy City Manager Jeff Jenkins.

According to Rydell, sales and use tax reports submitted to the state comptroller show Samsung’s impact on sales and use tax collections is an estimated $300,000. He and Jenkins explained the sudden jump in collections occurred months after local activity began at the construction site due to a lag in the reporting system.

“The report from July contained activity that occurred in May,” said Jenkins. “The use tax component credits the community where the use of the equipment/ material is located. This is what occurred and was the first sign of Samsung construction at the site. Equipment, tangible property that is going to be used on-site was credited to Taylor at the point of use. This by far was the biggest factor in the sales tax increase for the July report.”

Other effects

However, Jenkins said there are other positive factors influencing the upwards trend in addition to the $17 billion 6-million square-foot behemoth making international headlines and literally altering Taylor’s horizon.

So far in 2022, Taylor has collected $4,228,797.14 in sales taxes, up 29.99% from $3,252,931.42 at this time last year.

New neighborhoods are rising, accompanied by bustling construction in Taylor. Since last year, there have been hundreds of new residential permits entered into the city’s system. The population is also increasing, meaning more consumers.

“More new residents in Taylor have helped increase sales in general over the last several years,” said Jenkins.

Taylor has also seen new retail and dining developments and shifts in shopping patterns. The COVID-19 pandemic has folks staying closer to their residences.

“Residents and surrounding communities want to be closer to home, for a variety of reasons. Therefore, they are shopping in Taylor more often,” said Jenkins. “Taylor’s retail trade population is about 41,000 with a lot of residents from cities to the north and east shopping in Taylor for necessities. Residents to the west of Taylor are coming additionally for unique shopping and dining experiences, as they may not have these opportunities in their downtown or close by.”

Residents have mentioned other causes for dollar figures going up, such as national inflation. According to the U.S. Bureau of Labor Statistics, consumer prices rose 9.1% for the largest one-year increase in 40 years.

In reviewing other east Williamson County cities’ sales tax collections from July this and last year, Hutto was up 16%, Granger was up 10%, Thrall was up 31% and Coupland was down nearly 4%.

Compared to other Texas cities with the biggest jump in monthly sales-tax collections from one year earlier, Taylor ranks 34th in the state with the largest increase for July. Quintana, a coastal town with a 2020 census population of 56, was first with an 806% increase in sales-tax collections. Palestine, located in East Texas with a population of 18,544 (comparable to Taylor), ranked ninth with 178.43%

“Maybe, just maybe,” said Rydell, “the incredible increase in sales and use tax revenue for Taylor has something to do with one of the largest economic development projects in Texas and U.S. history having gotten underway in our city.”

What is Taylor’s sales tax rate?

Texas imposes a 6.25% state sales and use tax on all retail purchases, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions can also impose up to 2% sales and use tax for a maximum combined rate of 8.25%.

To break it down, half of the city’s 2% sales and use tax rate goes toward the city general fund for personnel, projects, equipment, programs and general operations.

The other 1% is split different ways.

“0.5% goes to the Taylor Economic Development Corp.,” said Jenkins, “which is utilized for personnel, operations and towards efforts to attract additional primary employers to Taylor.”

The remaining collections are used to help lower the property-tax rate.

“Since the adoption of an additional sales and use tax by the voters of Taylor in 1993, one half of 1 percent of Taylor sales and use tax dollars goes toward reducing the property tax rate,” said Rydell. “So, the more the city collects in sales and use tax, the more the property tax rate will go down.”

To examine sales tax rate history in a city, visit https://mycpa.cpa.state.tx.us/taxrates/RateHist.do.

How else will this help?

In addition to property tax ramifications, city staff already have ideas in mind of how to utilize the extra sales and use tax collections.

“The city has planned in the next year’s budget for additional purchases in equipment, projects and one-time expenses as this effect continues into the next year,” said Jenkins. “Altogether these additional purchases will help fund one-time programs, operational needs and projects. Citizens will see the impact as these changes will improve our community.”

Since the city is focused on expanding local restaurant and retail opportunities, the impacts may continue.

“One of the goals is to continue to attract shoppers outside of Taylor to shop in our community,” said Jenkins. “These additional sales can help our existing businesses, help fund our city and assist with offsetting the city property-tax rate with the additional sales.”

What is sales and use tax?

The Texas Comptroller of Public Accounts collects data on sales and use tax together. As such, they are occasionally referred together as sales taxes.

“There’s two components of it,” said Jeff Jenkins, deputy city manager. “You go to a store and buy a product, a sale is occurring on the spot. You’re going to consume or take it from that store and take it home with you. That’s when you’re charged the sales tax of that arm of sales and use tax.”

Use tax is a nonrecurring tax that is complementary to sales tax and is imposed on the storage, use or other consumption of tangible personal property or a taxable service in Texas.

“It’s where the transaction may have occurred someplace else. It might not occur in Taylor,” said Jenkins. “It’s going to occur in some other community or online ordering system, but it’s credited — the actual use and consumption of that equipment or tangible — it’s being used in Taylor, and so it’s credited to Taylor itself.”

Texas sellers are required to collect and remit sales and use tax to the Comptroller’s Office on their sales of taxable items or obtain a resale or exemption certificate in lieu of collecting the tax.

A Texas purchaser owes state and local use tax if he or she buys taxable goods and services that are stored, used or consumed in Texas from a seller who does not charge Texas sales tax. If the seller does not have a permit or fails to charge sales and use tax, the purchaser must pay the use tax directly to the government unless an exemption applies.

To learn more, visit https://comptroller.texas.gov/taxes/sales.

More on East Williamson County

Hutto levies a 2% sales tax for a combined rate with the state of 8.25%. Thrall, Granger and Coupland levy 1.25% sales taxes to combine with the state at 7.5%. Hutto’s sales taxes collected

Hutto’s sales taxes collected in July were $928,575, up 20.39% from $771,528.97 in July 2021. This year, Hutto has collected $5,955,416.59, up 16.07% from $5,955,416.59 at this time last year.

Thrall’s July figures of $8,379.20 are up 31.13.% in comparison from last July’s $6,389.89. Thrall has collected $63,477.88 so far this year, up 24.43% from $51,014.22 one year earlier.

Granger is up more than 10% in both July and year-to-date figures compared to last year. Granger’s July collections went up from $9,007.06 last year to $8,926.23. Year-to-date totals from this time in 2021 to 2022 are up from $64,573.42 to $71,484.83.

Coupland has started to collect fewer sales taxes after their sales tax rate lowered from 2% to 1.25% as of April. The city collected $3,379.85 in July, down from $5,060.99 in July last year. Year-to-date, Coupland is 3.83% down from this point last year with $33,799.76 collected in 2022.

Williamson County’s government does not impose a sales tax. Less than half of Texas counties, 124 out of 254, collect a sales tax. Bastrop and Milam are the two closest examples of counties with a sales tax.

For more information, visit https://comptroller.texas.gov/ transparency/local/allocations/sales-tax/cities-by-county.php.